|

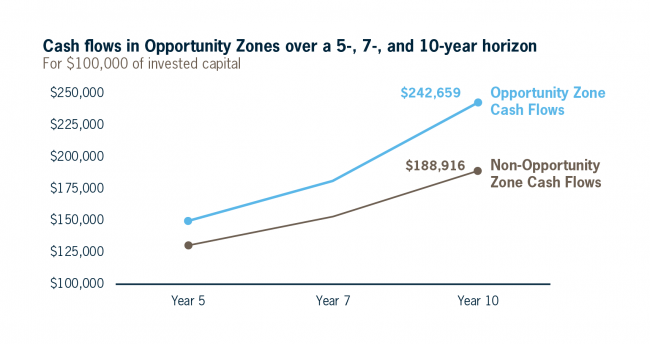

The Opportunity Zones program, established via the Tax Cuts and Jobs Act, aims to spur long-term private sector investments in low-income communities nationwide. Investors in Qualified Opportunity Funds participating within designated Qualified Opportunity Zones can take advantage of federal tax benefits in exchange for their contributions to economic growth and investment in distressed communities. Project sponsors can also benefit from lower-cost capital generated by the program. How it works: The Opportunity Zones program offers federal tax incentives for investing unrecognized capital gains in Qualified Opportunity Funds, which are investment vehicles created specifically for these purposes. The amount of benefit ultimately recognized depends on the holding period of the investment.

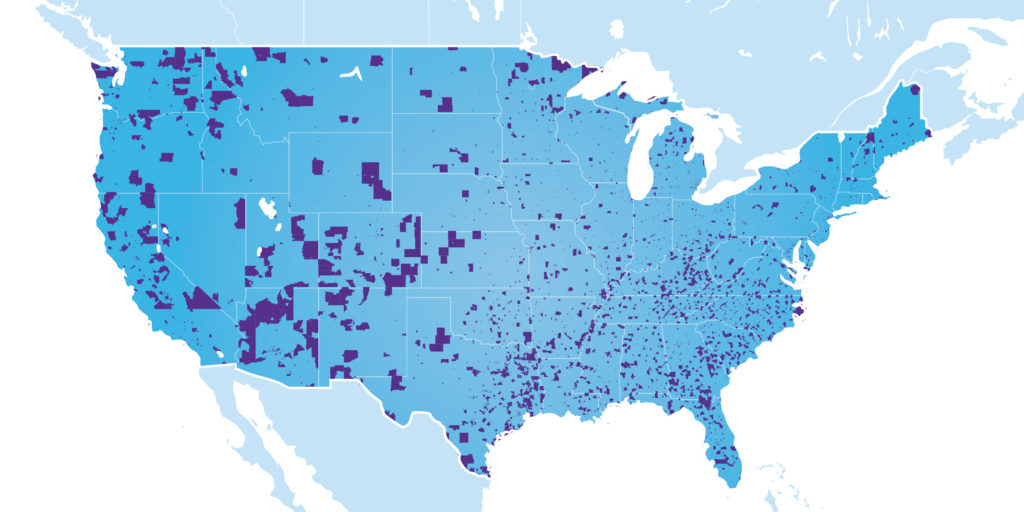

How to establish a certified Qualified Opportunity FundEligible taxpayers may self-certify to become a Qualified Opportunity Fund by attaching to its tax return Form 8996. No approval or action by the IRS is required. Where are the Opportunity Zones?Use the interactive map provided by Baker Tilly to search the complete list of Opportunity Zones that have been nominated, certified and designated. What’s next? There are a number of open issues surrounding the Opportunity Zones that require guidance from the U.S. Treasury Department or Internal Revenue Service. The first round of guidance arrived in late October and more is anticipated by year-end. We expect the additional guidance to focus on open questions related to operational issues, such as the availability of the 31-month runway for the deployment of funds in a direct investment model and the ability for residential rental property with a triple net lease to qualify as an active trade or business for the purpose of qualification as qualified Opportunity Zone business property. We will provide regular updates as the program continues to take shape and investment criteria and timing is outlined.

0 Comments

Leave a Reply. |

AuthorArchives

March 2020

CategoriesThe NY Accounting, Tax and Advisory Expert Blog |

RSS Feed

RSS Feed