|

Should you pay Junior to vacuum? Perhaps. While most parents can’t get their kids to clean a counter or put away dishes, perhaps putting kids to work at the office is a good option.

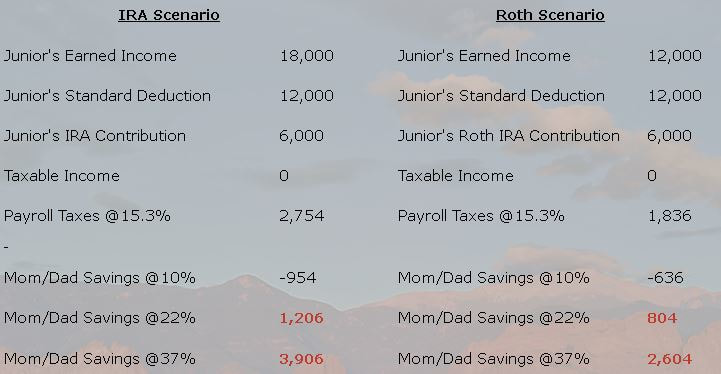

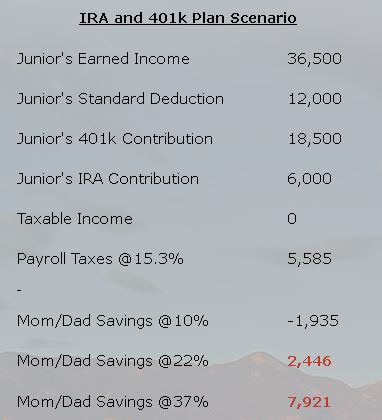

Tax Advantages There are some minor tax advantages to paying your children- for example, you can pay your child $12,000 in wages, and since the standard deduction for 2018 is $12,000 the child will have not have any taxable income. This will not affect your ability to take the tax exemption for your child, another bonus. If you pay yourself this income through a shareholder distribution and you are in the 10% tax bracket, you will unnecessarily pay about $636 in income taxes (since payroll taxes are 15.3% and your tax savings is 10%, 5.3% x 12,000 is $636). Your kids are going to take your money anyways- might as well make it tax-advantaged. Using our example above, your tax savings must exceed your tax costs. Simply put, your marginal tax rate must exceed 15.3%. You could also pay your child more money since their tax bracket is probably lower than yours. After payroll is processed, they can gift up to $15,000 per year back to you. Almost hard to say with a straight face. For regular LLCs, if your child is under 18, the business does not have to pay employment taxes such as Social Security, Medicare and Workers’ Compensation Insurance. You can also avoid Unemployment taxes until the child turns 21. But for S Corps and C Corps, Social Security and Medicare taxes are paid regardless of age. Retirement Accounts Your child can contribute to a retirement account and reduce your taxes. Seriously? Seriously! For example, a 14 year old can have an IRA or a Roth IRA and contribute 100% of earned wages up the maximum contribution. And since the wages to the child are a direct business expense, this reduces your overall taxable income (lower S Corporation income, lower pass-through income, and lower shareholder taxes). The standard deduction and IRA limits are for 2019. There are several things at play here. First, Junior must actually work and this is the biggest bone of contention with the IRS. So, get that squared away. Second, Junior and the business will pay 15.3% in payroll taxes, which represent their portions of Social Security and Medicare. Non-refundable, can’t avoid it. Therefore the 15.3% is a reduction in available cash and it decreases Mom and Dad’s savings. But since Junior’s marginal rate is zero, the 15.3% might still less than Mom and Dad’s marginal tax rate (22% and beyond). Wait! There’s more! Mom and Dad still get the dependent exemption on their joint tax returns. A win-win. Another issue to consider is support. If Junior is 18 or younger, it doesn’t matter. But if Junior is going to college and Mom and Dad are paying him to work at the family business, in order for Mom and Dad to take the dependent exemption of Junior, they must provide over half of the Junior’s support. This gets tricky, but there are easy arguments for it. So, there is real savings and Junior is already saving for retirement. A Roth IRA contribution is not deductible while an IRA contribution is, which is why the IRA scenario can have a higher salary. There is not a minimum age for an IRA or Roth IRA- you simply need to have earned income to contribute. And Yes, the money is the child’s so when Junior turns 18 and wants to blow it on a new car, it’s gone plus penalty. You can’t fix everyone. Company-Sponsored Retirement Plan A company-sponsored plan could be a SIMPLE, SEP or 401k plan. The usual age for these types of plans is 21, but the plan may be created or adopted to be as low as 14 years of age. So if you hire your 14 year old and you also have a 19 year old working for the business, that 19-year old suddenly becomes eligible if your company-sponsored plan allows 14 year-olds. There are hours of service thresholds you could implement as well. But setting up the 401lk plan correctly allows your child to contribute $18,000 to a 401k or the maximum limits on SIMPLE’s and SEP’s which can be significant. In turn the business gets an instant deduction and the kid gets your money, albeit a bit early. Conceivably, your child could have a $36,500 salary and contribute all kinds of money to his or her 401k plan and IRA- IRA and 401k Plan Scenario The standard deduction, 401k and IRA limits are for 2019. So the rule is this- if you are covered by a retirement plan at work (what the IRS calls active participation), and you earn less than $64,000 (2019) adjusted gross income (which Junior does), you can contribute both to a 401k plan and IRA, and get the IRA deduction. Here is a link about the various options for small business owners to set up retirement- www.wcgurl.com/401k IRS and State Concerns You must be mindful of child labor laws, and as far as the IRS is concerned there are some rules too. First, the child must actually perform work. Some argue that cleaning bathrooms and stuffing envelopes are different since cleaning bathrooms is non-essential to the business operations and therefore not qualifying. The counter argument is that having your child clean bathrooms replaces your third party janitorial expense. Our advice is to be as legitimate as possible- create a job description, list of expectations, etc. Ensure that the work they do has a business connection. Also, the pay must be consistent and the pay must be reasonable relative to what you pay others for similar work. Basically you need to treat them like any other employee to avoid troubles. Lastly, you need to keep detailed records such as time cards and job descriptions (of course you do!). This must be a perceived as an arms-length relationship. Many states have labor laws that dictate the age your child can work, even for Mom and Dad. For example, Indiana allows a 14-year-olds to work with a permit. Minors under 14 may work as newspaper carrier, golf caddy, domestic service worker in a private residence (sounds like chores) or farm laborer. Minors under 12 in Indiana can only be farm laborers. Again in Indiana, there is no need for a work permit if the work is outside school hours of 7:30AM to 3:30PM. We bring these examples to light so you understand to check your state or local laws about hiring your kids.

0 Comments

Are Mortgage Points Tax Deductible?

When you took out a mortgage to buy your home, did you pay points? You may be able to deduct that prepaid interest on your federal tax return — but only if you meet a long list of rules. The points you paid when you signed a mortgage to buy your home may help cut your federal tax bill. With points, sometimes called loan origination points or discount points, you make an upfront payment to get a particular rate from the lender. Since mortgage interest is deductible, your points may be, too. If you itemize your deductions on Schedule A of IRS Form 1040, you may be able to deduct all your points in the year you pay them. Some high-income taxpayers have their total itemized deductions limited, including points. You can read more about that in the instructions for Schedule A. Lucky for you, the IRS doesn’t care whether you or the homesellers paid the points. Either way, those points are your deduction, not the sellers’. Tip: Tax law treats home purchase mortgage points differently from refinance mortgage points. Refinance loan points get deducted over the life of your loan. So if you paid $1,000 in points for a 10-year refinance, you’re entitled to deduct $100 per year on your Schedule A. The Fine Print for Deducting Points The IRS rules for deducting purchase mortgage points are straightforward, but lengthy. You must meet each of these seven tests to deduct the points in the year you pay them. 1. Your mortgage must be used to buy or build your primary residence, and the loan must be secured by that residence. Your primary home is the one you live in most of the time. As long as it has cooking equipment, a toilet, and you can sleep in it, your main residence can be a house, a trailer, or a boat. Points paid on a second home have to be deducted over the life of your loan. 2. Paying points must be a customary business practice in your area. And the amount can’t exceed the percentage normally charged. If most people in your area pay one or two points, you can’t pay 10 points and then deduct them. 3. Your points have to be legitimate. You can’t have your lender label other things on your settlement statement, like appraisal fees, inspection fees, title fees, attorney fees, service fees, or property taxes as “points” and deduct them. 4. You have to use the cash method of accounting. That’s when you report your income to the IRS as it comes in and report your expenses when you pay them. Almost everybody uses this method for tax accounting. 5. You must pay the points directly. That is, you can’t have borrowed the funds from your lender to pay them. Any points paid by the seller are treated as being paid directly by you. In addition, monies you pay, such as a down payment or earnest money deposit, are considered monies out of your pocket that cover the points so long as they’re equal to or more than points. Say you put $10,000 down and pay $1,000 in points. The down payment exceeds the points, so your points are covered and therefore you can deduct them if you itemize. If you were to put nothing down but you paid one point, that $1,000 wouldn’t be deductible. 6. Your points have to be calculated as a percentage of your mortgage. One point is 1% of your mortgage amount, so one point on a $100,000 mortgage is $1,000. 7. The points have to show up on your settlement disclosure statement as “points.” They might be listed as loan origination points or discount points. Tip: You can also fully deduct points you pay (for the year paid) on a loan to improve your main home if you meet tests one through five above. |

AuthorArchives

March 2020

CategoriesThe NY Accounting, Tax and Advisory Expert Blog |

RSS Feed

RSS Feed