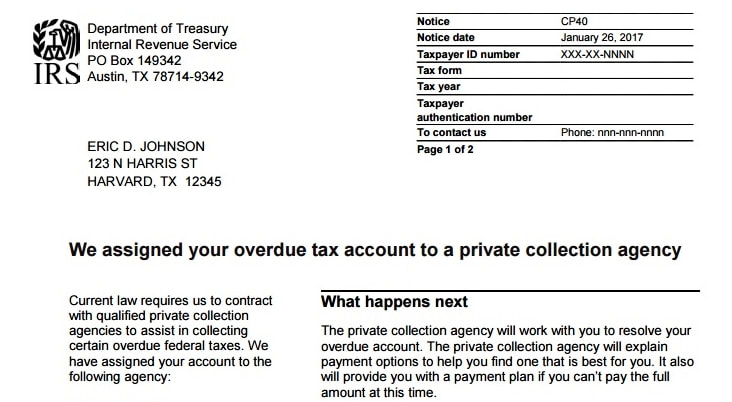

Have you been in receipt of one of these letters? Here are do' and don’ts to follow if you receive correspondence from the IRS or state tax authority: -Do immediately get a copy of the correspondence to this office so it can be reviewed and timely responded to. -Don’t respond if the correspondence requests personal information. There has been substantial identification theft related to scam artists pretending to be the IRS or another authority, especially correspondence by e-mail. Let this office take a look before responding. -Don’t procrastinate or throw the letter in a drawer, hoping the issue will go away. Most of these letters are computer-generated and, after a certain period of time, another letter will automatically be generated. And, as you might expect, each succeeding letter will become more aggressive and less easily dealt with. -Don’t automatically pay an amount the correspondence is requesting unless you are positive you owe it. Quite often, you will not owe what is requested, and it will be difficult to get your payment back. Call us today if you have questions related to a correspondence you received from the IRS or state authority. t: 516.427.7313 or e: [email protected]

1 Comment

|

AuthorArchives

March 2020

CategoriesThe NY Accounting, Tax and Advisory Expert Blog |

RSS Feed

RSS Feed