|

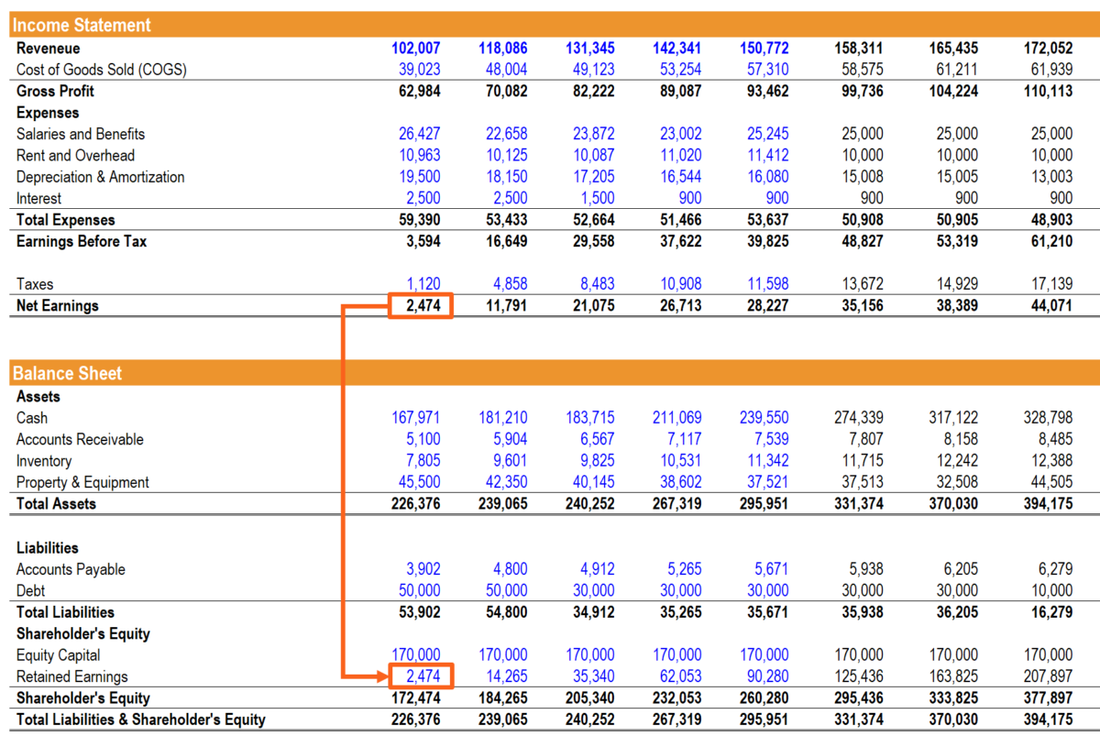

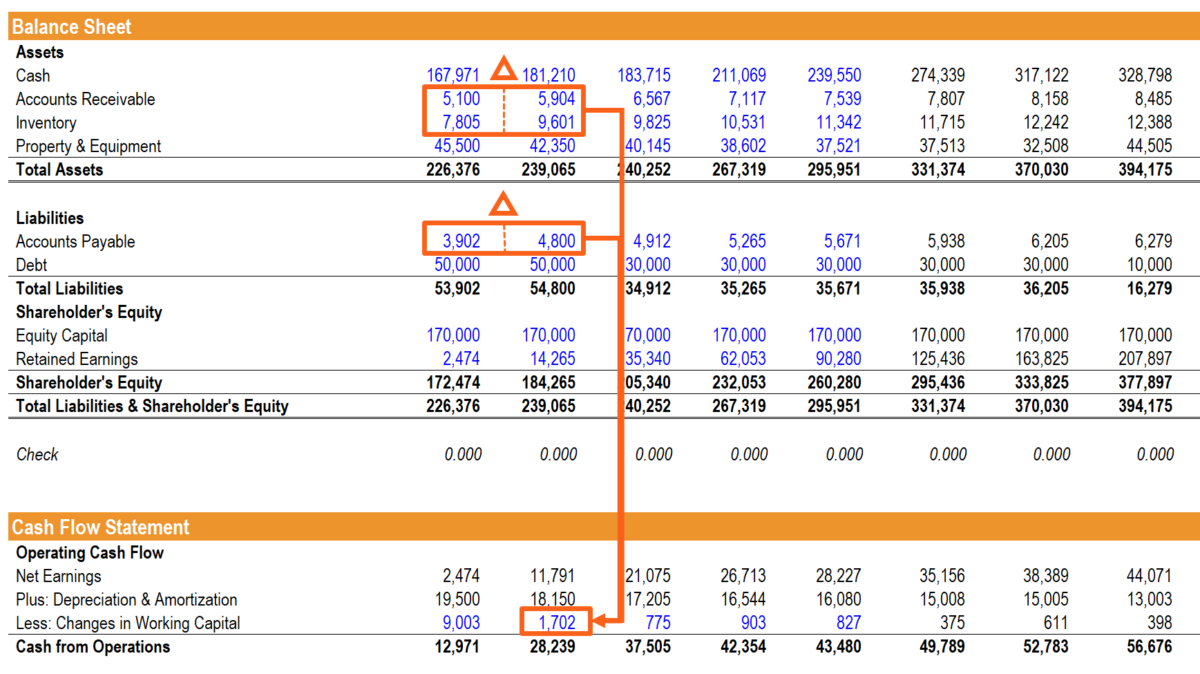

Net Income & Retained Earnings Net income from the bottom of the income statement links to the balance sheet and cash flow statement. On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for the cash from operations section. PP&E, Depreciation, and Capex Depreciation and other capitalized expenses on the income statement need to be added back to net income to calculate the cash flow from operations. Depreciation flows out of the balance sheet from Property Plant and Equipment (PP&E) onto the income statement as an expense, and then gets added back in the cash flow statement. For this section of linking the 3 financial statements, it’s important to build a separate depreciation schedule. Capital expenditures add to the PP&E account on the balance sheet and flow through cash from investing on the cash flow statement. Working Capital Modeling net working capital can sometimes be confusing. Changes in current assets and current liabilities on the balance sheet are related to revenues and expenses on the income statement but need to be adjusted on the cash flow statement to reflect the actual amount of cash received or spent by the business. In order to do this, we create a separate section that calculates the changes in net working capital. It's critical to understand how certain events in your business will change these statements and lead to changes to your bottom-line. Let Us Help. Call MRB Now.

3 Comments

7/2/2020 01:57:50 am

What will be your opinion if I say that besides several beneficial debt relief options; the debtors are still suffering from their massive unsecured credits? You will certainly reply in affirmative due to the fact that those vehicles which are necessary for smooth functioning of these relief programs are not showing their legitimate performance. Let me clear my statement, by vehicles, I am indicating the fraudulent and scam debt relief companies which are taking the advantages of intense necessities of the debtors and are operating only for money making motives by whatever means.

Reply

Leave a Reply. |

AuthorArchives

March 2020

CategoriesThe NY Accounting, Tax and Advisory Expert Blog |

RSS Feed

RSS Feed