|

Small business owners and CEOs often ask us for advice on how to formulate a capitalization policy for their companies. To persons outside of accounting, the term “capitalization policy” may conjure up thoughts of junior high English and the rules of when to capitalize on persons, places and things. However, when talking about accounting, capitalization has to do with how a company accounts for the purchase of items necessary for the operation of the business. Capitalization’s effects on your business’ financial statements This article will help you understand: the accounting concept of capitalizing assets, how capitalization works, and why that’s important. Once you understand that, we will explain how to set up a customized capitalization policy for your business. By having a written capitalization policy, your company will have set parameters to follow to help decide how to record and account for the costs of business expenditures. When to Capitalize With every purchase, a business must decide whether to:

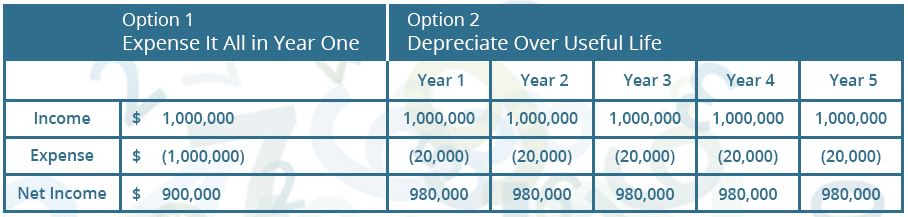

The process records the cost of an asset by adding it to the balance sheet, which increases the worth of the company, and reduces its value to the company over its useful life by a series of monthly or annual journal entries. The decision whether to capitalize an asset or not is a critical business issue because it could influence the profits or losses of a business. The P & L results, in turn, can affect the business’s net worth, its tax liability and potentially debt covenants – the financial ratios required by a lender. Because this has such a big impact on the value of a company, the accounting profession and the IRS have established guidelines on what is considered a fixed asset versus an expense. To understand those guidelines, you first need to understand the difference between the two types of assets. A fixed asset is a long-term resource used in the operation of a business such as property, plant or equipment – usually, a new or replacement purchase that is a major expense for the business. The key qualifications of a fixed asset are:

A normal operating cycle is considered the time period a business takes to buy and sell inventories, including collecting payments and paying any creditors. GAAP Fixed-Asset InclusionsFixed assets can include costs beyond the base purchase price of an item. The Generally Accepted Accounting Principles (GAAP) allow for various inclusions in fixed asset costs. When calculating the price of a fixed asset for capitalization, companies are permitted to include expenses related, or necessary, to the purchase. GAAP standards allow the following costs to be tacked on to the purchase price when capitalizing a fixed asset:

The Internal Revenue Service has established “tangible property” regulations governing a business’s fixed asset record keeping. The IRS rule states that fixed assets, at certain thresholds, should be capitalized by a business. For example, say that the purchase price of a truck for a lawn care business is $50,000. The expenditure would be treated as a fixed asset, because the purchase meets the two requirements of a fixed asset by:

On the other hand, when the truck undergoes scheduled maintenance, those charges are deducted as an expense of the business because they do not materially improve the value of the vehicle or increase its years of service. Those costs are just ordinary costs of using the asset. A rule of thumb to use when totaling fixed-asset expenditures is to ask whether the components are functionally interdependent - also known as a unit of property. An example of interdependency is buying new tires for that truck, which cannot run without tires. Therefore, the truck and its four new tires are deemed a unit of property for accounting purposes. Another helpful technique to determine whether expenditures should be capitalized is to use the BAR test. The IRS says a purchase must be capitalized if it results in a betterment (B), adaptation (A) or a restoration (R ) of the unit of property. If the purchase does not meet the BAR test, it should be considered an expense and deducted accordingly on the income statement. IRS Fixed-Asset Thresholds The IRS suggests you chose one of two capitalization thresholds for fixed-asset expenditures, either $2,500 or $5,000. The thresholds are the costs of capital items related to an asset that must be met or exceeded to qualify for capitalization. A business can elect to employ higher or lower capitalization thresholds. However, the IRS requires that a business uses the same threshold for tax purposes that it uses for accounting purposes. How Capitalization Works Now that you know how to identify fixed-asset expenditures in your business, how should you go about capitalizing them? You must go through the following exercise for each potential fixed-asset purchased by your business:

Writing a Capitalization Policy We recommend that all businesses establish a capitalization policy in writing. A written capitalization policy will help your bookkeeper and accountants prevent immaterial expenses from appearing on the balance sheet. In addition, the policy will provide these benefits:

By setting fixed-asset thresholds and requirements, you will ensure a proper balance between expenses and assets appropriate for your business operation. Most importantly, your monthly financial reports will reflect the true financial picture for your company and point towards operational business success.

0 Comments

|

AuthorArchives

March 2020

CategoriesThe NY Accounting, Tax and Advisory Expert Blog |

RSS Feed

RSS Feed